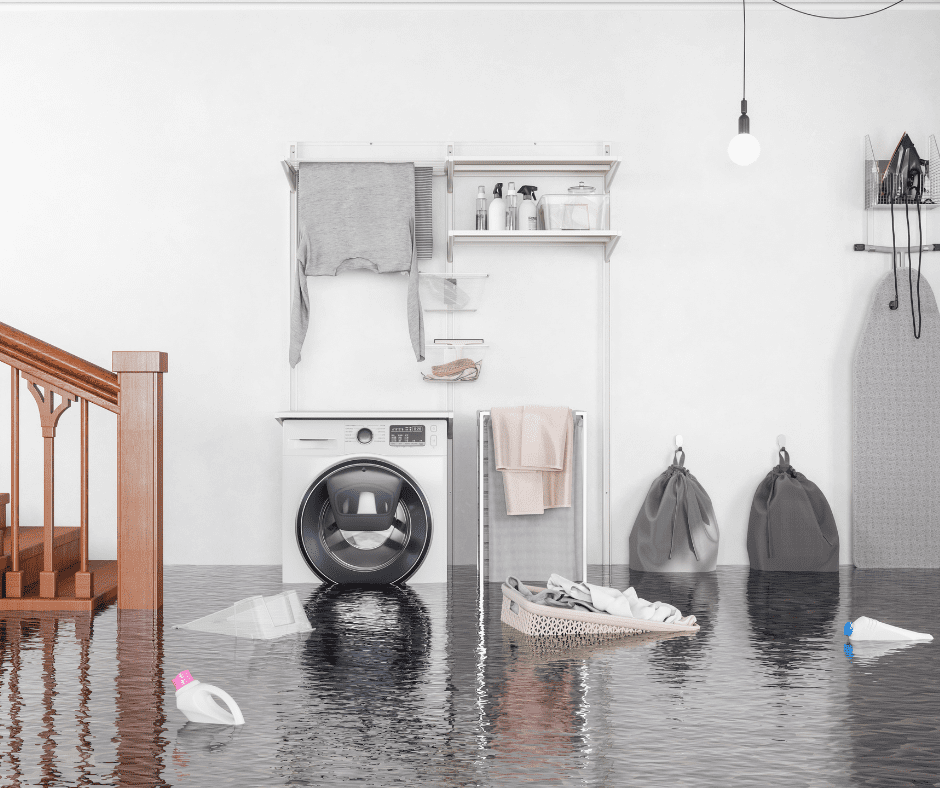

What Does Flood Insurance Cover?

Flood insurance covers damage to your home and the contents within your home due to the infiltration of water from an outside source. The National Flood Insurance Program (NFIP) definition of a flood is quite specific. A flood may be caused by rising tides, overflowing river banks or any sudden surge of water. Flood insurance does not cover water damage from a washing machine with a broken water supply hose or from an overflowing bath tub. Any water damage that originates from inside your home is generally covered by your home insurance policy.

When you buy a flood policy, you protect yourself from the potential for large out-of-pocket expenses should a flood occur and damage your home and/or your personal possessions. You are covered up to the limits of your policy and coverage begins after the amount of the damage exceeds your chosen deductible.

Protection for Your Home

After the flood waters have receded and you make an initial assessment of the situation, you may find some obvious signs of water damage. The carpet may be drenched and you might see the high-water line on the walls. Some damage may not be so obvious. Depending on the severity of the flooding, you may need to hire a professional restoration company. They can assess all of the damage and create a detailed report to present to the insurance company when you file a claim. A standard flood insurance policy should cover:

- Damage to your home’s structure and foundation

- Your electrical and plumbing systems

- Major appliances including stoves, refrigerators and dishwashers

- Your HVAC system including central air, furnaces and water heaters

- Any permanently installed carpeting, paneling, wallboard, bookcases or cabinets

- Blinds for your windows

- Detached garages are covered for up to 10 percent of your building property coverage

- The cost of debris removal

Coverage for Your Personal Property

You are covered for most of the contents that are inside your home. The list includes non-attached appliances such as washing machines, dryers and microwave ovens. It includes room air conditioners, carpets that can be moved and curtains. Other personal possessions like clothing, electronics and furniture are eligible. You may also receive coverage of high-value items such as art and furs, subject to a $2,500 limit. However, you can add to the coverage of valuables by purchasing a policy endorsement.

Some Things are Not Covered

Cash, gold coins, property outside of an insured structure, temporary housing and cars are generally not covered by flood insurance. Basements and other areas below the elevation of the lowest floor are usually not covered.

Talk to your agent about your specific flood insurance coverage needs. He or she can answer all of your questions and help you choose the right amount of coverage and the most appropriate deductible for your personal needs.

Tags: flood insurance